Why the Life Insurance Industry Can't Ignore Automation Any Longer

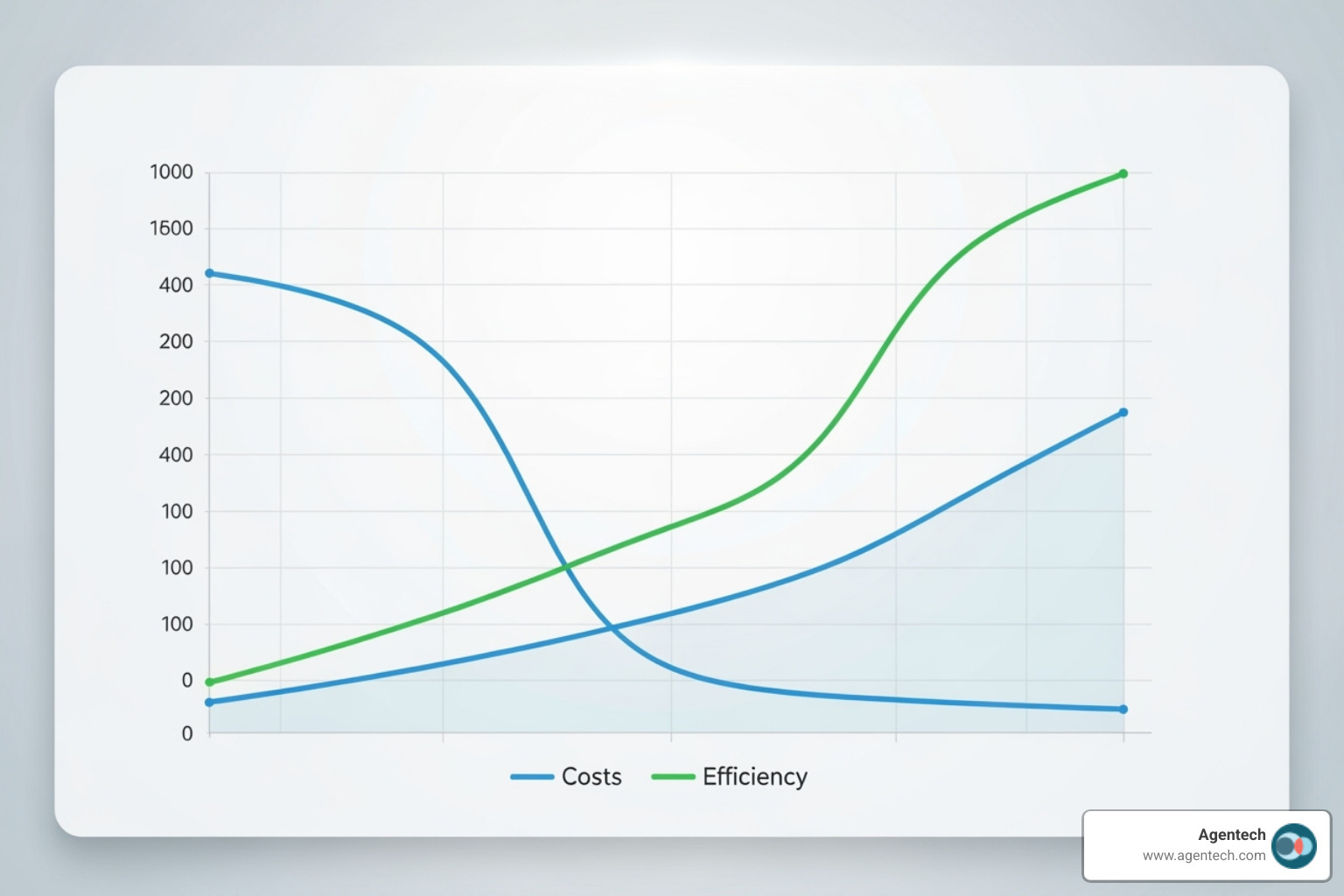

Automation in life insurance is revolutionizing core operations from underwriting and claims to customer service and fraud detection. By streamlining processes, insurers can achieve up to a 40% reduction in operational costs and 85% faster cycle times. Key applications include automated underwriting, claims processing, policy management, and regulatory compliance.

The life insurance industry, long defined by manual, paper-intensive work, is facing a critical shift. Today's customers expect instant quotes, quick approvals, and seamless digital experiences. Simultaneously, insurers are struggling with rising costs and complex regulations. Traditional methods are no longer viable.

McKinsey projects that by 2030, more than 90% of pricing and underwriting tasks will be fully automated. This transition is not just about improving efficiency—it's about survival in a digital-first market where competitors are leveraging AI to deliver superior service at lower costs.

I'm Alex Pezold, founder of Agentech AI. After building and scaling technology businesses like TokenEx, I am now focused on changing the insurance industry. At Agentech, we revolutionize claims processing with AI-powered solutions designed to augment, not replace, human expertise.

What is Intelligent Automation in Life Insurance?

Intelligent automation in life insurance combines Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) with cognitive capabilities like Natural Language Processing (NLP). Unlike traditional automation that handles only structured data, intelligent systems can interpret the unstructured information that makes up 80% or more of insurance data, such as medical reports and handwritten notes.

This technology doesn't just follow rules—it learns, adapts, and makes informed decisions. It can automate complex processes from application intake to claims settlement, freeing human experts to focus on higher-value work.

| Feature | Rule-Based RPA | AI-Powered Intelligent Automation |

|---|---|---|

| Data Handling | Structured data only | Structured, semi-structured, and unstructured data |

| Decision Making | Follows predefined rules | Learns from data, makes cognitive decisions |

| Complexity | Simple, repetitive tasks | Complex, knowledge-based processes |

| Adaptability | Limited to programmed rules | Adapts to new data and situations |

| Scalability | Can be challenging with variability | Designed for high variability and volume |

The goal isn't to replace human expertise but to augment it. To understand how this fits into the bigger picture, check out The Future of Insurance: How AI is Changing the Game.

The Role of Robotic Process Automation (RPA)

RPA uses software bots to mimic repetitive human actions like data entry, form filling, and moving data between systems. It excels at high-volume, rule-based tasks such as generating routine correspondence or sending payment reminders. However, RPA struggles with unstructured data and variations in processes, as it cannot adapt beyond its pre-programmed rules. This creates scalability challenges when dealing with the messy, real-world documents common in life insurance. While effective for simple tasks, RPA requires AI to handle true operational complexity.

How Artificial Intelligence (AI) Lifts Operations

AI brings the cognitive capabilities needed to handle the complex, unstructured data that limits RPA. It can understand context, learn from experience, and make smart decisions. For example, AI can read medical records for underwriting, power 24/7 customer support chatbots, and use predictive analytics to identify potential fraud in claims data. Generative AI further improves this by drafting customer responses and creating personalized content.

Companies using AI report significant ROI and revenue increases, with 90% of professionals noting faster customer service. The real power of AI is in handling complex data analysis, allowing your team to focus on relationship building and strategic decisions. Our approach at Agentech, detailed in AI Designed with Adjusters in Mind, is built on this principle of improving human expertise, not replacing it.

The Transformative Impact of Automation in Life Insurance

The impact of automation in life insurance is a fundamental shift in how insurers operate and serve customers. It creates smoother, faster processes that deliver significant benefits across the board.

One of the primary benefits is significant cost reduction, with some insurers cutting operational costs by up to 40%. Automation also drives operational efficiency, turning processes that once took weeks into tasks completed in minutes. This speed ensures policyholders get faster service from application to claims.

Furthermore, automated systems improve accuracy and compliance. By minimizing the human error common in manual processes, automation ensures data integrity and helps meet regulatory requirements, avoiding costly fines. It also boosts employee satisfaction by freeing teams from repetitive tasks to focus on more strategic and rewarding work. This approach is key to tackling the industry's labor challenges, as we discuss in Solving the Insurance Labor Crisis with AI-Driven Innovation.

Slashing Operational Costs and Boosting Productivity

Automation delivers game-changing improvements to productivity and costs. By automating core tasks, insurers can reduce process cycle times by as much as 85% while simultaneously improving accuracy. This allows companies to handle higher volumes of applications and claims with existing resources.

This efficiency gain stems from eliminating manual effort. For example, one insurer saved 132,000 hours annually by automating 460 different tasks. These hours can be reallocated to more valuable activities, like complex problem-solving and customer engagement. By reducing manual checks and data entry, insurers can achieve up to a 40% cost reduction, building a leaner and more competitive business. For more insights, see this resource from EY.

Elevating the Customer and Employee Experience

Beyond cost savings, automation in life insurance significantly improves the experience for both customers and employees. Customers now expect instant, 24/7 service, which AI-powered chatbots and virtual assistants can provide. These tools offer immediate support, answer questions, and give real-time updates on policies and claims, boosting satisfaction and loyalty.

Employees also benefit greatly. The average underwriter spends about 40% of their time on administrative tasks. Automation handles this repetitive work, allowing employees to focus on rewarding, strategic tasks that require their expertise. This shift reduces burnout and improves job satisfaction by allowing talented people to solve complex problems and build customer relationships. We explore this further in Designing for the Future: How AI Transforms the Claims Experience.

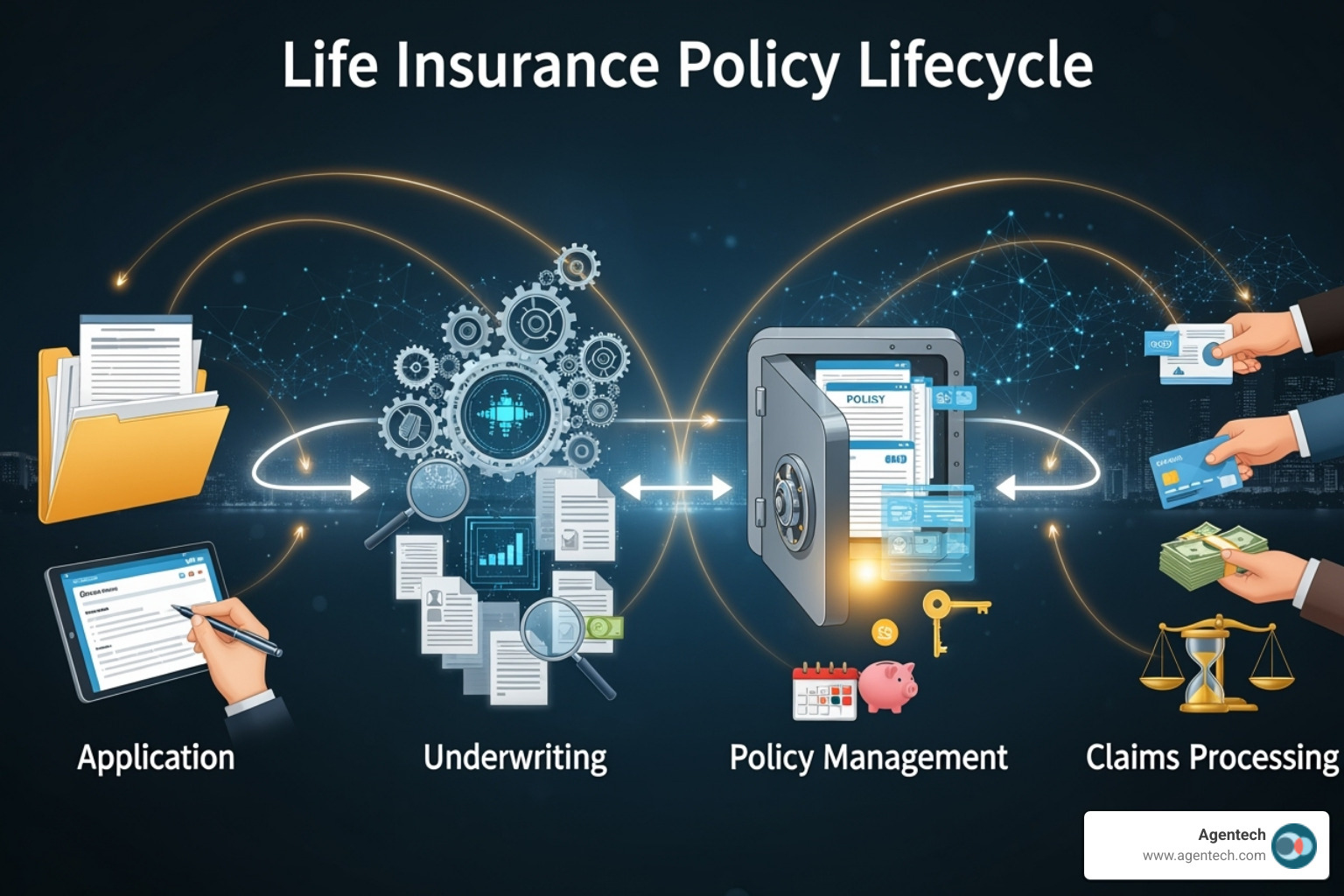

Key Use Cases for Automation Across the Policy Lifecycle

The value of automation in life insurance is most evident when applied across the entire customer journey, from initial application to final claim.

Automation makes underwriting faster and more accurate by enabling AI to instantly analyze medical and financial data. Claims processing is transformed from a lengthy ordeal into a streamlined, supportive experience. Beyond these, policy management, fraud detection, and even sales and marketing benefit from automated, intelligent processes that build trust and improve service.

Revolutionizing Underwriting with Intelligent Data Processing

Intelligent automation in life insurance is ending the era of slow, paper-based underwriting. Automated data collection is the first step, where AI instantly gathers and organizes information from multiple sources, eliminating manual review and lost paperwork. The key breakthrough is in risk assessment and dynamic pricing. Machine learning algorithms analyze vast datasets to identify risks and opportunities that human analysis might miss. McKinsey projects that by 2030, most pricing and underwriting tasks will be automated. Finally, policy issuance is automated, generating documents and processing applications in days or hours, not weeks. This is the kind of efficiency we focus on at Agentech, such as when we made AI do the most tedious, time-consuming task in claims processing: creating the claim profile.

How automation in life insurance streamlines claims

Claims processing is where automation provides critical support to families in need. Automated claims intake allows beneficiaries to begin the process 24/7 through AI-powered systems that collect necessary documents with clarity and compassion. During claims assessment and validation, AI analyzes complex reports and policy documents to validate claims quickly and accurately, fast-tracking legitimate cases while flagging potential issues for human review. Settlement and payment automation ensures beneficiaries receive funds without delay once a claim is approved. This end-to-end automation can reduce cycle times by up to 85%.

Enhancing Fraud Detection and Prevention

With insurance fraud costs the U.S. $308.6 billion annually, automation provides a powerful defense. AI uses pattern recognition and anomaly detection to analyze millions of data points simultaneously, spotting subtle indicators of fraud that are invisible to human reviewers. Predictive modeling then assigns risk scores to new claims, allowing investigators to focus their attention where it's most needed. This real-time analysis flags potential fraud instantly, not months later, protecting honest policyholders from higher premiums and preserving the integrity of the system.

Adopting and Scaling Automation in Your Insurance Practice

Embracing automation in life insurance is a strategic journey that requires careful planning and a clear vision. Successfully navigating this path means understanding potential challenges and following a structured roadmap.

Navigating Implementation Challenges

Successfully implementing automation requires overcoming several common problems:

- Legacy Systems: Integrating new AI and RPA solutions with older IT infrastructure requires careful planning and often a phased approach.

- Data Security and Privacy: Handling sensitive customer data demands the highest standards of protection, adhering to regulations like HIPAA and SOC 2 Type 2.

- Regulatory Compliance: Automation technologies must be implemented in a way that ensures all processes remain fair, transparent, and compliant with evolving insurance laws. We explore this in AI in Insurance: Balancing Innovation and Regulation.

- Change Management: Automation alters job roles and workflows. Effective change management, including clear communication and training, is vital to ensure employee buy-in.

- Human Oversight: While automation excels at routine tasks, human oversight remains essential for complex decisions. Our AI assistants are designed to augment adjuster productivity, not replace their critical judgment.

A Strategic Roadmap for Effective Adoption

A step-by-step approach is key to successfully adopting and scaling intelligent automation:

- Start Small: Identify low-risk, high-impact processes for pilot projects. Quick wins build confidence and demonstrate ROI.

- Select a Flagship Project: Choose a more significant, customer-facing process to showcase automation's transformative potential and secure broader investment.

- Build a Dedicated Team: Assemble a cross-functional team of experts from IT, operations, and compliance to oversee implementation and ensure alignment.

- Expand Your Automation Efforts: Scale successful initiatives across the enterprise, tackling more complex processes and integrating advanced AI capabilities.

- Embed Automation in Your Company's Culture: Foster a mindset of continuous improvement and digital innovation. Offer upskilling programs to help employees adapt and view automation as an enabler of growth.

The Future of automation in life insurance

The journey of automation in life insurance is just beginning. The future promises hyper-personalization, proactive risk management, and new ways of working.

The rise of Agentic AI will introduce "digital coworkers" capable of managing entire workflows with minimal human oversight, freeing up people for strategic thinking and relationship building. We explore this in The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers. This will enable hyper-personalization, with policies that dynamically adapt to a customer's life stages. Proactive risk management, using data from IoT devices, will help prevent losses before they occur. Companies that accept these advancements will build more resilient, customer-centric businesses.

Frequently Asked Questions about Automation in Life Insurance

Here are answers to some of the most common inquiries we receive about automation in life insurance.

Will automation replace life insurance agents and adjusters?

No. Our philosophy is that automation is about augmentation, not replacement. The goal is to give your human teams superpowers, not to eliminate their roles. Automation handles repetitive, administrative tasks, freeing up your employees for high-value work.

- Agents can spend less time on paperwork and more time building client relationships and providing expert advice.

- Adjusters are empowered by AI assistants that process documents and flag issues, allowing them to focus on complex investigations, customer empathy, and critical decision-making.

The aim is to shift talented employees from low-value tasks to strategic work that requires human judgment and creativity, boosting efficiency and allowing them to serve customers more effectively.

What is the first step to implementing automation in a life insurance company?

The best first step is to start small with a clear, high-impact use case. Instead of overhauling your entire system at once, identify a specific process that is manual, repetitive, or error-prone. Define clear goals for what you want automation to achieve, such as reducing cycle time or improving data accuracy.

Run a small-scale pilot project to test the technology and demonstrate its value. A successful pilot that shows a tangible return on investment (ROI) will build internal confidence and secure the buy-in needed for broader, more ambitious automation initiatives.

How does automation handle sensitive customer data and ensure privacy?

Protecting sensitive customer data is paramount. Our automation in life insurance solutions are built with security and privacy at their core, using a multi-layered approach:

- Strict Regulatory Compliance: We build our solutions to adhere to key industry regulations like HIPAA, CCPA, ISO 27001, and SOC 2 Type 2, ensuring data is handled according to the highest legal and ethical standards.

- Secure Technology: We use advanced security measures like data encryption, strict access controls, and comprehensive audit trails to protect information within secure environments.

- Ethical AI Frameworks: We are committed to responsible AI development. Our models are designed to be fair and transparent, and we continuously monitor them to prevent bias and protect sensitive information.

This foundational commitment to security ensures that our systems improve efficiency while steadfastly protecting customer privacy.

Conclusion

The life insurance industry is at a pivotal moment, changing from a slow, paper-based sector into a dynamic and responsive one. Automation in life insurance is the driving force behind this evolution.

Intelligent automation, combining AI, ML, and RPA, is delivering remarkable results: 85% faster process times, 40% lower operational costs, and thousands of hours saved. These systems can read unstructured documents, detect fraud, and streamline underwriting, fundamentally reshaping what is possible.

Crucially, automation is making the industry more human. By handling tedious administrative work, it frees agents and adjusters to focus on what they do best: building relationships, applying expertise, and providing empathetic support to customers.

Looking ahead, technologies like Agentic AI will introduce "digital coworkers," enabling hyper-personalized policies and proactive risk management. Companies that accept automation are not just future-proofing their operations; they are building faster, more efficient, and more customer-centric businesses.

At Agentech, our AI-powered tools are designed to amplify the human touch, not replace it. We handle the repetitive work so your team can focus on the complex decisions that build trust and protect the people who depend on you.

Explore how Agentech's AI Agents can transform your operations