Understanding the Evolution from Hype to Reality

Agentic AI tools are changing how developers create intelligent systems that can think, plan, and act on their own. Unlike generative AI that only responds to prompts, these tools build AI agents that understand goals, make decisions, and perform tasks with multiple steps with little human input.

Key categories of these tools include:

- Multi-Agent Frameworks for collaborative AI

- Orchestration Platforms to manage complex workflows

- AI-Powered Developer Environments that simplify agent creation

- Industry-Specific Solutions, such as specialized agents for P&C insurance

This shift is significant. While a generative AI can help write an email, an agentic system can manage your inbox, prioritize messages, draft replies, schedule follow-ups, and update your CRM automatically.

Gartner predicts that by 2028, 33% of enterprise software will use agentic AI, a huge jump from just 1% in 2024. This growth highlights the technology's power to handle complex business processes that demand reasoning and autonomous action.

The main challenge for developers is choosing and implementing the right tools. With only 25% of employees confident in using AI, the focus must be on solutions that are easy to use and provide clear business value.

I'm Alex Pezold, founder of Agentech AI, where we build the AI workforce for P&C insurance claims. I've seen how agentic AI tools can turn manual work that takes a lot of time into streamlined, autonomous workflows for P&C insurance carriers and adjusting firms. This guide shares practical insights for implementing agentic AI in your own projects.

What is Agentic AI? From Automation to Autonomy

Think of agentic AI tools as digital employees that can think through problems. Unlike basic automation, these systems have "agency"—the ability to set their own goals and complete complex tasks with minimal supervision. They don't just follow scripts; they actively solve problems and adapt.

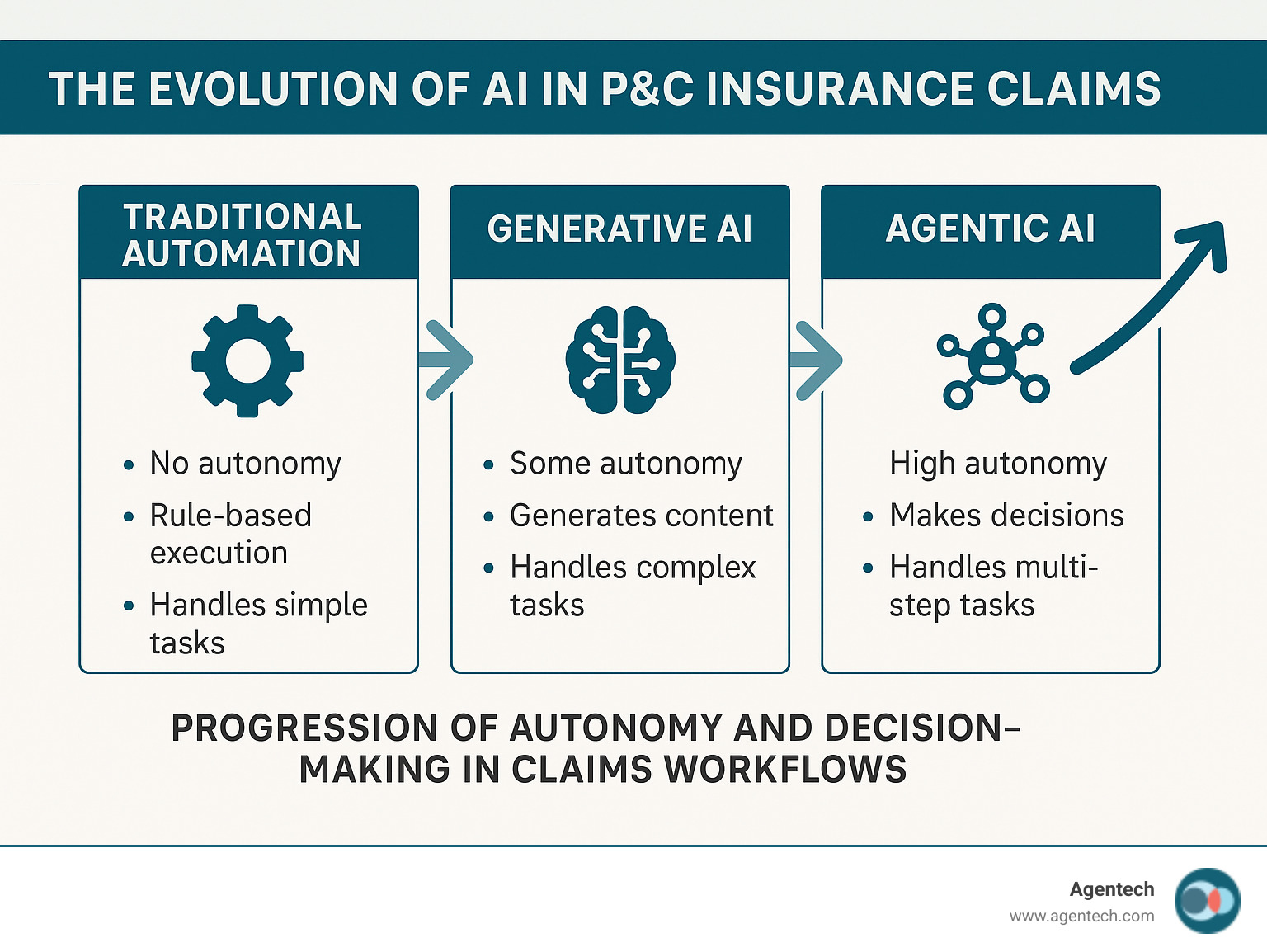

Let's see how this compares to previous technologies:

Feature

Traditional Automation (RPA)

Generative AI (e.g., ChatGPT)

Agentic AI

Autonomy

Low (based on rules)

Medium (assists, generates)

High (oriented by goals, corrects itself)

Task Complexity

Simple, repetitive

Complex content generation

Complex, multiple steps, dynamic

Decision Making

Predefined rules

Suggestions based on patterns

Oriented by goals, adaptive, learned

Human Oversight

High (setup, monitoring)

Moderate (prompting, refining)

Low (initial setup, strategic oversight)

Adaptability

Low

Moderate

High (learns from experience)

Example Use Case

Data entry, form filling

Content creation, summarization

Claims processing, autonomous project management

Traditional automation handles repetitive tasks, while generative AI creates content but needs constant direction. Agentic AI tools bridge the gap between thinking and doing, combining language model flexibility with autonomous action. They can browse the web, use APIs, and interact with software to achieve objectives.

These systems operate in a continuous cycle: they perceive data, use reasoning to process it, set goals, make decisions, and execute actions. They then learn from feedback to improve over time, allowing them to handle new situations effectively. For P&C insurance, this means systems that can manage the full complexity of claims processing. To learn more, explore our Agentic AI Definition.

Core Capabilities of Agentic Systems

The strength of agentic AI tools is their ability to think ahead and adapt. They use autonomous planning to break down high-level goals, like "process this property damage claim," into smaller, executable tasks without needing a detailed map of every step.

With multi-step reasoning, they handle complex scenarios. For instance, an agent can analyze medical reports for a workers' compensation claim, reference policy details against other data, and check regulations, maintaining context throughout.

Crucially, these systems feature self-correction. If a required document is missing, an agent doesn't just stop. It might contact the right person, flag the issue, and proceed with other parts of the task. Their tool use capability allows them to make API calls to claims management software, browse websites for information, and interact with services from other companies. This turns complex software interfaces into simple natural language commands, boosting productivity. Learn more in our Rise of the Machines: A Friendly Guide to Agentic AI.

The Role of AI Orchestration

Just as an orchestra needs a conductor, individual AI agents need AI orchestration to work together on complex tasks. Orchestration coordinates multiple specialized agents, allowing you to deploy focused agents that excel at specific roles while ensuring they collaborate seamlessly.

In P&C insurance claims, this is essential. For a complex auto accident, one agent might analyze documents while another communicates with involved parties and a third reviews policy coverage. The orchestration platform manages task delegation and information flow between them. This centralized control prevents chaos and enables harmonious productivity.

Instead of replacing your existing claims software, these orchestrated agents improve it, automating repetitive work within your current systems. This approach using multiple agents is a fundamental shift in P&C insurance claims processing. See how it works in our article on Changing P&C Insurance Claims: The Evolution from Generative AI to Agentic AI.

A Developer's Guide to Building with Agentic AI Tools

Building with agentic AI tools is a new frontier in development. You're not just writing code; you're creating digital minds that can adapt and solve problems. As a developer of AI agents for P&C insurance claims, I know the right tools are the key to turning a frustrating experiment into a breakthrough solution. Modern agentic tools handle much of the complexity, letting you focus on designing agents that deliver business value.

Multi-Agent Frameworks for P&C Insurance

A single AI agent isn't enough for complex P&C insurance claims. Collaborative AI through multi-agent frameworks is a significant change. These frameworks let you create specialized agents that work as a team. For an auto claim, one agent could review policy details while another analyzes the accident report. A third might handle policyholder communication, and a fourth coordinates with repair shops.

Each agent has a specialized role, enabling the solving of complex problems and changing claims software automation. The framework manages communication and the handoff of tasks, creating a seamless workflow for even the most complicated claims. These agents integrate with your existing claims management software, automating the research and analysis tasks that consume an adjuster's time. See how we implement this in our Agentech Multi-Agent Solutions, where agents like Ingrid and Clyde have distinct roles.

Orchestration Platforms for Claims Management

Once you have a team of AI agents, you need to manage them. Orchestration platforms for claims management act as the conductor. The best platforms offer visual workflow design, allowing developers and business users to map out processes visually. This is invaluable in P&C insurance, where claims involve many steps and systems.

Integration with enterprise systems is where these platforms excel. They handle connections to policy management systems and claims management software, ensuring agents can access and update information without manual work. They also provide the scalability to handle growing claim volumes and the governance features P&C insurance companies need, including audit trails and access controls. This is essential for trusted P&C insurance claims automation. Learn more about our agent deployment at AI Agents.

AI-Powered Developer Environments

Development environments for agentic AI tools have evolved dramatically. You can now describe what you want in plain English and see it become reality. This shift to AI agent creation via natural language is making AI development more accessible.

Development driven by specifications is changing the process. You start with a clear description of the agent's goal, and the environment translates it into code. This shortens the time from concept to production code and simplifies the development cycle. You can focus on business logic instead of technical details. This workflow from prompt to production is powerful for creating specialized agents for P&C insurance tasks, enabling rapid prototyping. AI tools are now helping build better AI agents faster. See an example of this new approach at Introducing Kiro, which shows how modern AI IDEs are changing development.

Key Features to Look for in Agentic AI Tools

Choosing the right agentic AI tools is like hiring a new team member: you need reliability, trustworthiness, and capability. With only about 25% of employees feeling confident using AI tools, being easy to use is paramount. Flashy features are useless if they don't solve real problems. The focus should be on tools that integrate into your existing workflows.

The best agentic AI tools connect effortlessly to your systems, maintain high security standards, and can reason through complex problems like your best human employees.

Integration and Extensibility

An agentic AI tool must communicate with your existing technology stack. API connectivity is the foundation, allowing agents to pull policy details, update claim statuses in your claims software, and interact with other systems without entering data manually. The ability to support custom tool creation is also crucial for specialized workflows.

Compatibility with existing stacks is what separates a useful tool from a forgotten one. In P&C insurance, this means smooth CRM integration, ERP integration, and deep claims software integration. The best tools improve your current processes, not force you to rebuild them.

Security, Governance, and Trust

In P&C insurance, trust is non-negotiable. You handle sensitive data and must meet strict compliance requirements. Your agentic AI tools must be as conscious of security as your most careful adjuster.

Audit trails are essential. Every AI decision should be traceable and explainable. Explainable AI (XAI) makes the AI's reasoning transparent. Access controls based on roles ensure users and agents only access necessary information. Data encryption protects information at rest and in transit. Finally, tools must ensure compliance with regulations like GDPR, with compliance built into their architecture.

Reasoning and Planning Capabilities

This is where agentic AI tools truly stand apart from simple automation. The ability to reason is what makes them so useful for P&C insurance claims.

Planning that is aware of context means an agent understands the different steps for a workers' compensation claim versus an auto accident claim. Complex request understanding allows agents to interpret nuanced instructions from an adjuster.

Dynamic trees for decisions let agents adapt their strategy when new information emerges, such as shifting from a simple claim process to a fraud investigation. Business rule integration ensures AI agents follow the same company and regulatory policies as your human team. This sophisticated reasoning is what transforms a task automator into a true digital coworker.

Evaluating and Implementing Agentic AI in the Enterprise

Successfully implementing agentic AI tools requires more than just choosing new technology. It's about finding solutions that transform how your team works while fitting into your operations. Our experience building AI agents for P&C insurance claims has taught us that thoughtful planning and realistic expectations are key. The landscape is evolving fast, and navigating it requires a strategic, practical approach.

Choosing the Right Agentic AI Tools for Your Project

Finding the right agentic AI tools is a critical investment in your team's future.

- Define specific scenarios for use. Instead of a vague goal like "we need AI," identify exact pain points, such as the manual review of auto claim photos or chasing missing documents for workers' compensation claims.

- Assess your technical environment. An AI system is useless if it can't connect to your existing claims management software. Ensure the tool offers integrations for your core platforms and data formats.

- Be realistic about implementation resources. Choose solutions with intuitive interfaces that your team can deploy and manage without needing advanced technical skills.

- Calculate your total cost of ownership. Look beyond the license fee to include implementation, customization, maintenance, and talent costs.

- Plan for scalability. Choose solutions that can grow with your business, whether that means handling more claims or adapting to new regulations.

Mitigating Risks and Challenges

While powerful, agentic AI tools introduce new risks. Their autonomy can lead to unpredictability if not managed correctly.

- Reliability concerns are valid. The adaptive nature of agentic systems means you need robust monitoring and procedures for fallback.

- Hallucination prevention is critical in P&C insurance, where accuracy is a legal requirement. Safeguards must be in place to catch and correct errors before they impact claims.

- Cascading failures in multi-agent systems are a risk. An error by one agent can trigger a chain reaction. Careful system design and error handling are essential to prevent this.

- Oversight with a human in the loop is a core design principle. The goal is to augment human judgment, not replace it. Our agents work alongside adjusters, handling repetitive tasks while humans control key decisions. This partnership makes AI a valuable digital colleague. Learn more in The Future of Work in P&C Insurance: Embracing AI Agents as Digital Coworkers.

The Future Outlook: Emerging Trends

The world of agentic AI tools is moving quickly. Staying ahead of trends will position your organization for future opportunities.

Agents specific to an industry are becoming the norm. In P&C insurance, this means specialized agents for auto claims, workers' compensation, and residential property that understand the unique details of each area.

Extreme personalization is changing agent interactions. AI is learning to adapt its communication style based on individual preferences, improving customer satisfaction and adjuster productivity.

The Mixture of Agents architecture is an exciting evolution where networks of specialized agents collaborate dynamically based on a case's needs. This allows for great flexibility and deep expertise.

The shift to digital employees is happening now. Amazon's CEO Andy Jassy predicts billions of AI agents, but at Agentech, we already have hundreds actively processing P&C insurance claims. Our agents, like Ingrid and Clyde, are integral members of claims teams. This future is today's reality, as we detail in Amazon CEO Forecasts Billions of AI Agents as Coworkers, and Agentech is Already Powering P&C Insurance Claims with Hundreds.

Conclusion

We've moved far beyond AI as just a popular term. Today, agentic AI tools are practical systems handling complex business tasks that once required constant human effort. These are not simple chatbots; they are digital teammates that can think through problems, make decisions, and execute workflows with multiple steps with impressive autonomy.

The technology has become practical. While challenges like reliability and human oversight exist, they are manageable with thoughtful implementation. The key is to focus on integration capabilities, robust security, and systems with genuine reasoning skills.

The future is exciting, with the rise of highly specialized agents for industries like P&C insurance. These systems are becoming true digital colleagues, designed to understand the nuances of auto claims, workers' compensation, and property damage assessments.

At Agentech, we see this change daily. Our agents, Ingrid and Clyde, are not just processing P&C insurance claims; they are demonstrating the power of agentic AI tools designed with deep industry knowledge. They work alongside human adjusters, streamlining claims processing and reducing administrative burdens.

This isn't about replacing the human element; it's about amplifying it. When AI agents handle repetitive tasks, adjusters can focus on complex investigations and customer relationships. This is the promise of agentic AI: intelligent partnership that makes everyone more effective. The shift from hype to reality is here.

If you're ready to see how AI agents can transform your P&C insurance operations, we can show you what's possible. Learn how AI agents are changing the P&C insurance industry and find how this technology can work for you.